How to Process Deductions & Expenses

Uniform Deductions

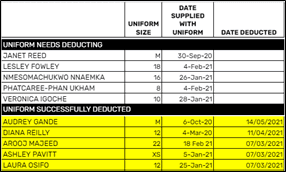

Uniform Deductions of £15 need to be taken from any of the new starters who have had one. In the head office, we keep a record of all the uniforms that are given out and if they have been deducted from the temp workers’ wage.

Create a new spreadsheet called ‘Uniform Deductions’ on Google Drive. Whenever a uniform is sent out to an Agency worker you must ensure you add the information onto the sheet so that the uniform can be deducted from their wages.

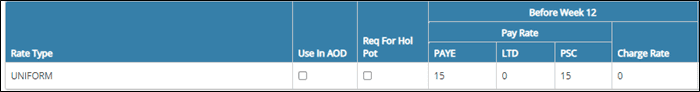

If you haven’t already, you will need to create a Client using your Ltd company name and then create a rate card on that client for Uniform Deductions. (Please refer to the ‘Using Systems’ module within the ‘Business Development’ module on the Tezlom Academy for training/guidance on how to set up a Client & Rate).

Your rate card should look like the below.

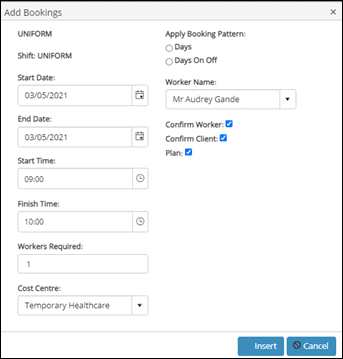

If the rate card is already set up, you will need to create a booking for the uniform, so it shows on your plan. (Please refer to the ‘Client Bookings’ module within the ‘Bookings’ module on the Tezlom Academy for training/guidance on how to create a booking.)

The booking should look like the below.

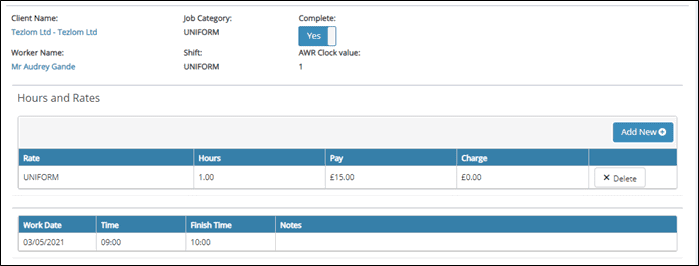

Similar to a timesheet, you need to go into the entry on the plan -> Enter ‘1’ in the ‘Hours’ -> Click ‘Complete’.

This will turn the entry green on the plan, and it is ready for processing.

Once you have completed the above you then need to yellow the agency worker on the uniform deduction list to show it has been deducted and move them to below the black line.

Deductions & Expenses

Any other deduction: Advance Recoveries, DBS or Training, or expenses are to be actioned in the same way as a Uniform Deduction. A rate card will need setting up on your Ltd Company Client -> A booking will then need creating for that week -> Enter ‘1’ in the ‘Hours’ and amend the Pay Rate to the amount that needs deducting/ paying -> Ensure there is no amount in the charge rate -> Click ‘Complete’.

This will turn the entry green on the plan, and it is ready for processing.